Reports 35 Percent Year-over-Year Increase in Platform Annual Recurring Revenue to $4.7 Million

HENDERSON, Nev., Nov. 12, 2020 / PRNewswire / — Research Solutions, Inc. (NASDAQ: RSSS), a pioneer in providing cloud-based workflow solutions for R&D driven organizations, reported financial results for its fiscal 2021 first quarter ended September 30, 2020.

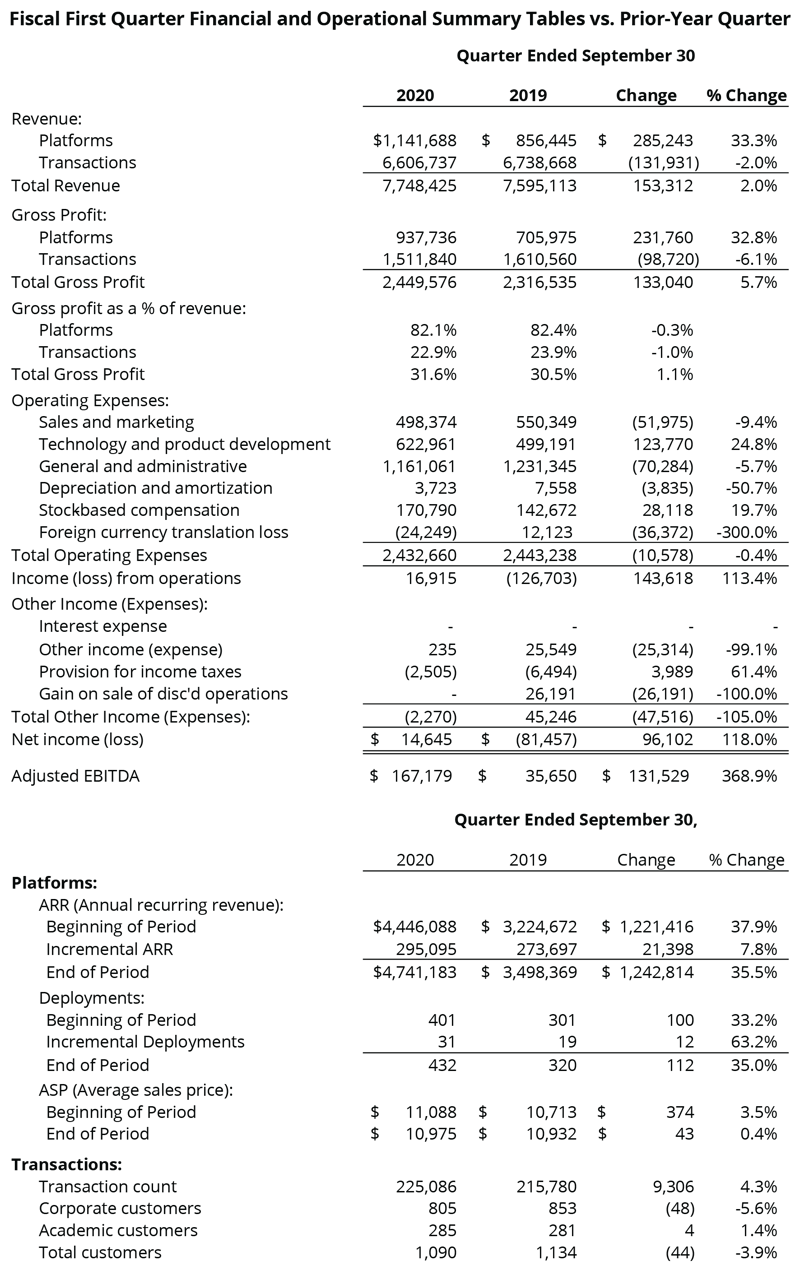

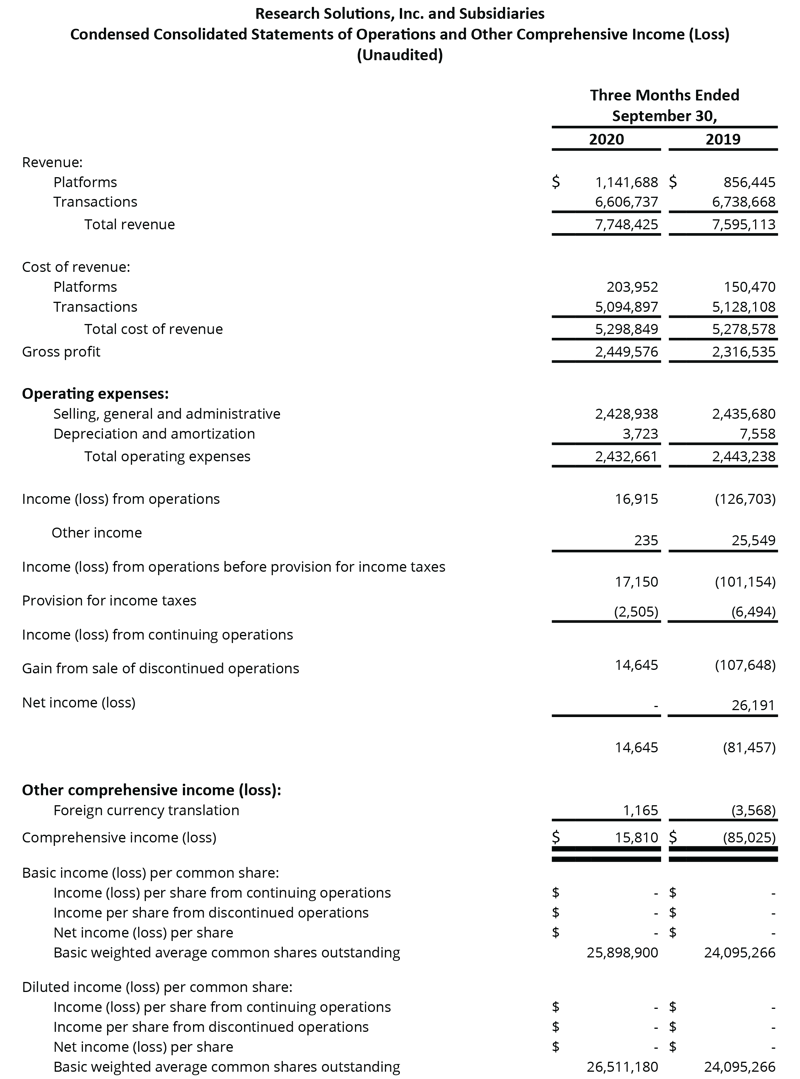

Fiscal First Quarter 2021 Summary Compared to Prior Year Quarter:

- Total revenue increased 2% to $7.7 million

- Platform revenue up 33% to $1.1 million, Annual recurring revenue up 35% to $4.7 million

- Total gross margin improved 110 basis points to 31.6%

- Net income of $15,000, an improvement of $96,000; diluted earnings per share of nil

- Adjusted EBITDA of $167,000, an improvement of $131,000

"The sustained momentum within our Platforms business is evident in our first quarter fiscal 2021 results, with 31 net new deployments in the quarter and a record for Annual Recurring Revenue," said Peter Derycz, President and CEO of Research Solutions. "We continue to enhance the product initiatives and offerings through Article Galaxy research platform to simplify, accelerate and lower the cost of information access for our users, including many within the life sciences field that continue to work on therapeutics and vaccines for COVID-19. We believe we remain well-positioned to grow our business through ongoing product improvements to our Article Galaxy platform, additional partnership opportunities, such as our most recent partnership with BIO Business Solutions, and our refined lead generation and sales approach."

Fiscal First Quarter 2021 Results

Total revenue increased 2% to $7.7 million, compared to $7.6 million in the same year-ago quarter.

Platform subscription revenue increased 33% to approximately $1.1 million compared to $856,000 in the year-ago quarter. The increase was primarily due to an increase in the total number of paid Platform deployments, including 31 net deployments added in the quarter. The quarter ended with annual recurring revenue of $4.7 million, up 7% sequentially and 35% year-over-year (see the company's definition of annual recurring revenue below).

Transaction revenue decreased 2% to $6.6 million compared to $6.7 million in the prior-year quarter. Transaction count increased 4.3% from the year-ago quarter to 225,000, with 1,090 transaction customers, compared to 1,134 customers in the first quarter of fiscal year 2020 (see the company's definition of active customer accounts and transactions below).

Total gross margin improved 110 basis points from the prior-year quarter to 31.6%. The increase was primarily driven by a continued revenue mix shift to the higher-margin Platform business.

Total operating expenses were $2.4 million, essentially unchanged from the year-ago quarter.

Net income in the first quarter was $15,000, or nil per diluted share, compared to a net loss of ($81,000), or nil per share, in the prior-year quarter. Adjusted EBITDA was $167,000, a $132,000 improvement from the year-ago quarter (see definition and further discussion about the presentation of Adjusted EBITDA, a non-GAAP term, below).

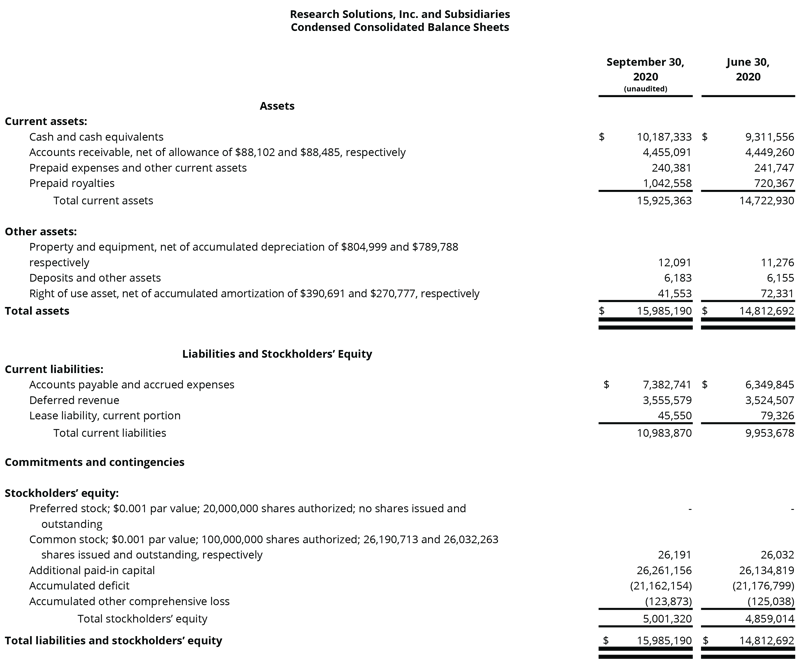

Cash and cash equivalents on September 30, 2020, amounted to $10.2 million compared to $9.3 million as of June 30, 2020. There were no outstanding borrowings under the company's $2.5 million revolving line of credit and the company had no long-term liabilities or other debt.

Conference Call

Research Solutions President and CEO Peter Derycz and CFO Alan Urban will host the conference call, followed by a question and answer period.

Date: Thursday, November 12, 2020

Time: 5:00 p.m. ET (2:00 p.m. PT)

Toll-free dial-in number: 1-855-327-6837

International dial-in number: 1-631-891-4304

Conference ID: 10011712

The conference call will be broadcast live and available for replay until December 3, 2020, by dialing 1-844-512-2921 and using the replay ID 10011712, and via the investor relations section of the company's website at researchsolutions.investorroom.com.

Active Customer Accounts, Transactions and Annual Recurring Revenue

The company defines active customer accounts as the sum of the total quantity of customers per month for each month in the period divided by the respective number of months in the period. The quantity of customers per month is defined as customers with at least one transaction during the month.

A transaction is an order for a unit of copyrighted content fulfilled or managed in the Platform.

The company defines annual recurring revenue as the value of contracted Platform subscription recurring revenue normalized to a one-year period.

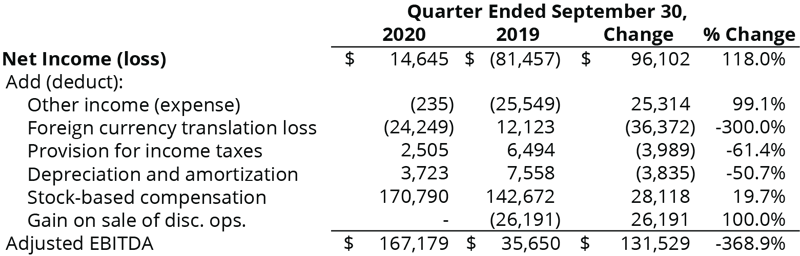

Use of Non-GAAP Measure – Adjusted EBITDA

Research Solutions' management evaluates and makes operating decisions using various financial metrics. In addition to the company's GAAP results, management also considers the non-GAAP measure of Adjusted EBITDA. Management believes that this non-GAAP measure provides useful information about the company's operating results.

The tables below provide a reconciliation of this non-GAAP financial measure with the most directly comparable GAAP financial measure. Adjusted EBITDA is defined as net income (loss), plus interest expense, other income (expense), foreign currency transaction loss, provision for income taxes, depreciation and amortization, stock-based compensation, gain on sale of discontinued operations, and other potential adjustments that may arise. Set forth below is a reconciliation of Adjusted EBITDA to net income (loss):

About Research Solutions and Reprints Desk

Research Solutions, Inc. (NASDAQ: RSSS) is a pioneer in providing seamless access and simplifies how organizations and individual researchers discover, acquire, and manage scholarly journal articles, book chapters and other content in scientific, technical, and medical (STM) research. More than 70 percent of the top pharmaceutical companies, prestigious universities, and emerging businesses rely on Article Galaxy, a cloud-based SaaS research platform, for simplified and lowest cost access to the latest scientific research and data. Featuring an ecosystem of app-like Gadgets for a personalized research experience, Article Galaxy offers individual as well as enterprise plans, coupled with unparalleled, 24/7 customer support. For more information and details, please visit www.researchsolutions.com and www.reprintsdesk.com

Important Cautions Regarding Forward-Looking Statements

Certain statements in this press release may contain "forward-looking statements" regarding future events and our future results. All statements other than statements of historical facts are statements that could be deemed to be forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the markets in which we operate and the beliefs and assumptions of our management. Words such as "expects," "anticipates," "targets," "goals," "projects", "intends," "plans," "believes," "seeks," "estimates," "endeavors," "strives," "may," or variations of such words, and similar expressions are intended to identify such forward-looking statements. Readers are cautioned that these forward-looking statements are subject to a number of risks, uncertainties and assumptions that are difficult to predict, estimate or verify. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Such risks and uncertainties include those factors described in the Company's most recent annual report on Form 10-K, as such may be amended or supplemented by subsequent quarterly reports on Form 10-Q, or other reports filed with the Securities and Exchange Commission. Examples of forward-looking statements in this release include statements regarding improved liquidity, an expanded investor base and driving long-term shareholder value as a result of listing on Nasdaq, continued momentum in the Company's business and financial performance, and the Company's strong outlook. Readers are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements are made only as of the date hereof, and the Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements. For more information, please refer to the Company's filings with the Securities and Exchange Commission.

Source: Research Solutions, Inc.

For further information: Steven Hooser or John Beisler, Three Part Advisors, (214) 872-2710, shooser@threepa.com, jbeisler@threepa.com

Leah Rodriguez | VP of Marketing

Leah has over 17 years of experience in publishing and software with various roles leading and developing marketing teams. Prior to joining Research Solutions, she was at Nature Publishing Group, launching marketing for their open access journals, Nature Communications and Scientific Reports and at PLOS, developing...